6777 7775

Sim Lim Tower, 10 Jalan Besar Sim Lim Tower #01-01, 208787

Apply for Home Renovation Loan in Singapore

Monetium Credit is one of the best legal moneylenders in Singapore. Our debt consolidation plans are extensive, affordable, and professional.

Monetium Credit Offers the Best Renovation Loan in Singapore

Our company specializes in offering advantageous financial packages with a favorable interest rate. Do you want to find the best renovation loan in Singapore? If so, you came to the right place. Do you require solutions for fixing a crumbling roof? Then, our company can be your number-one ally. We can offer you a personalized house renovation loan in Singapore, allow you to merge your existing debt into a singular payment, and help you with a payday loan.

From restoring dilapidated flooring to repairing damaged plumbing systems, whatever problem you have with your home will most likely be fixable if you obtain the best renovation loan in Singapore. We will offer a financial offer with an advantageous loan repayment duration, assist you with your specific maintenance projects, and offer complete transparency and support. We provide the best home renovation loan in Singapore. Plus, we are one of the most reputable financial institutions active in the country, and we are constantly seeking to improve our financial offerings and enhance our relationship with our loyal customers.

We are known to offer the best renovation loan deals in Singapore, and our reputation is preceded only by our varied financial packages.

Transparency

We are transparent with our services and follow the stipulations presented in the Moneylenders Act of 2009.

Efficiency

We can offer you a home renovation loan Singapore, ensure you get your money ASAP, and provide all the support required, fast, discreet, and efficient.

Why Always Choose a Licensed Moneylender in Singapore?

Are you searching for the best renovation loan in Singapore? Has your house suffered damage, and so you need a financial solution for fixing a crumbling roof, repairing damaged plumbing, restoring dilapidated flooring, or fixing damaged electrical system? Then, time is of the essence. By contacting our professionals, you can be sure that the home renovation loans you obtain come with official guarantees and that you have the full support of the Singaporean government.

Why go for a legal moneylender? One word – Safety!

Are you looking for the best renovation loan in Singapore? If so, you may have found an offer from an unlicensed money lender that sounds too good to be true. And it probably is. Unlicensed lenders promise advantageous interest rates. However, many then use predatory practices to extract more money from borrowers. Moreover, because they act outside the boundaries of the law, the contracts you sign with them are void, and you can fall into financial traps that are hard to get out of.

Choosing the services of a loan provider licensed by the Registry of Moneylenders is the most optimal solution if you are interested in the best renovation loan in Singapore. You get financial security guarantees, are protected from extortion practices, and have the full support of the Singaporean government’s national financial institutions.

Who is eligible?

For Fixed Salary Employees

- Singapore Citizen, Permanent Resident: Above Age: 21

- Employment Status: Full-time or Part-time

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Computerised payslip / CPF / Bank statement

- Residency proof: Household bills

- Employment contract (For new employment less than 6 months)

Disclaimer: We reserves the right to request for other documentary materials and proofs on a case-by-case basis.

What Documents Should I Prepare for a Loan Contract?

- Singapore Citizen, Permanent Resident: Above Age: 21

- Employment Status: Full-time or Part-time

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Computerised payslip / CPF / Bank statement / Income Tax

- Residency proof: Household bills

- Employment contract (For new employment less than 6 months)

Disclaimer: We reserves the right to request for other documentary materials and proofs on a case-by-case basis.

What Happens After the Loan Approval Process is Completed Successfully?

You are eligible if you are a business owner who may or may not be part of the following:

- A sole proprietorship, or Limited Liability Partnership (LLP)

- A private limited company

- A corporation

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Company payslip / Income Tax / CPF

- ACRA Document

- Minimum 2 months of company bank statements

- Corporate and income Tax assessment

What Is a Renovation Loan?

A home renovation loan Singapore gives you a much-needed boost to personalize your home into the designs you have dreamt of for a while. With the help of a reliable money lender in Singapore, you can transform your ideas into realization, from a dull-looking property space into the most outlandish living space. With these urgent cash loans, you can have the freedom to undertake any renovations that range from the electrical, plumbing, wiring, floor installation, repainting, purchasing of new furniture, kitchen, and bathroom remodeling, and any other adjustments that need to be made.

How Can I Get a Renovation Loan in Singapore?

Getting a home renovation loan application for renovating or expanding your house is easy with most money lenders in Singapore, because the application process occurs online. To avoid any unnecessary delays, make sure that you consider the following:

- Source and identify your needs as early as possible; make sure you already know what you need to do so that when you place your order, this makes it easier for your contractor to have a quote ready for you.

- Use a contractor that has been certified by the authorities. Your lender requires an official quotation from a certified contractor to process the home renovation loan application. These contractors will also provide an objective view of the renovations that you are about to carry out. The quotes are crucial in budgeting and quickly accessing your finances.

- Understand all requirements. To qualify, you must be a Singaporean or a Permanent Resident of Singapore (PR) aged 21 or above. Other requirements include proof of property ownership, proof of income for salaried and self-employed personnel, documentation such as NRIC copies, and CPF statements/NOA.

The Costs Of A Home Renovation Loan

According to recent studies, a home renovation loan for a new house in Singapore can easily cost between $10,000 and over $100,000, and sometimes it could be even more. Most of the time, you do not have such money lying around, and this is where a renovation loan comes in handy. Home upgrading loans are highly versatile, allowing you to carry out any renovations, such as floor installations, adding physical interior & exterior, having some décor redesigns, lighting, and bathroom and kitchen remodeling, among your other list of extensive changes.

The loan application process is easy and can be submitted online. If you are looking for an established renovation loan provider in Singapore, fill in the details below and let us match you to our list of subscribing money lenders.

Please submit your details here if you would like to request a loan. Rest assured that your online application will be processed as soon as possible.

Registered Licensed Lender in Singapore! Monetium Credit Is Here for Your Needs!

We are a professionally licensed lender with extensive experience in the SG market. We can offer various financial packages that will contribute to your business’s economic development and your family’s well-being.

Loan Options From Monetium Credit

Personal Loan

Do you want to invest in your family’s well-being? If so, we can offer you a loan for personal necessities with an advantageous interest rate that suits your requirements.

Payday Loan

Is money tight right now? Were you interested in finding the best renovation loan in Singapore, but now you are considering getting a payday loan? If so, we can offer you a solution characterized by flexible interest rates.

Business Loan

Are you looking for a way to start

a new venture? If so, you may be interested in a business loan. We can offer fantastic loan suggestions and help you with all required documentation.

Lifestyle Loan

Do you need a vacation? Have you got your eye on jewellery or a new phone? A lifestyle loan can be a perfect financial instrument for subjective requirements, as these credits are used for miscellaneous purchases.

Debt Consolidation Loan

Do you owe multiple debts? If so, going for a debt consolidation loan offered by a loan provider is an excellent idea. This type of financial instrument is characterized by flexible interest rates and a more extended repayment period, so it could be just what you need.

Mortgage Loan

A mortgage loan will allow you to purchase your dream home. As a professional loan provider, we understand your needs and will find a solution to help you buy your property at an advantageous price.

4 Advantages of Choosing Our Home Renovation Loan Options

Swift Loan Application

The application process for our financial services is straightforward. Whether you are looking for the best renovation loan in Singapore or are interested in another type of credit, our application process is fast and easy to understand.

Low Interest Rates

We will offer you a competitive interest rate that is more favorable than the ones provided by other private financial institutions in the city. As a renovation loan provider, our APR is capped at 48% per year, regardless of credit, and we are flexible with our repayment periods and the amounts we offer.

Flexible Loan Repayment

As a renovation loan provider, we are flexible about the repayment period of our credits and open to renegotiations to extend the repayment period of your existing loan. If you have difficulty repaying your renovation loan, that’s no problem. We can discuss a financial solution that works for you.

Personalized Services

We offer financial packages tailored to your specific requirements. Do you want to improve the look of your dwelling and seek the best renovation loan in Singapore from a professional renovation loan provider? If so, we can talk and reach a solution that works for everyone.

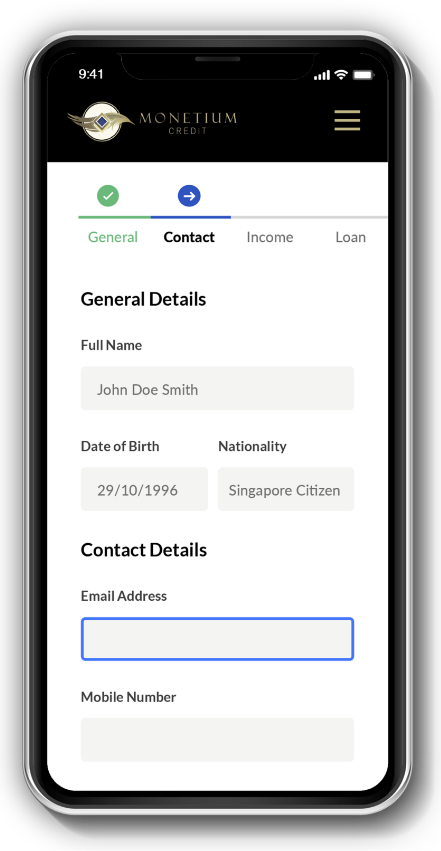

Choose The Form of Your Loan Application

Monetium Credit is a nationally recognized company, and we can offer you an advantageous loan designed to suit your requirements.

MyInfo

Manual Application

Best Renovation Loan Singapore in 3 Steps

Do you seek the best renovation loan in Singapore? The process is simple. Only submit an application form in which you’ll specify your full name/NRIC and provide contact information. Afterward, depending on the loan that interests you, we will ask for proof of income and check your credit history using the CBS. If everything checks out, your credit should be approved in less than 24 hours, and you will receive the money in your account within a couple of business days.

Fill in the form

The process starts with an application form where you will specify your personal information and confirm the type of loan you are interested in. You will need to upload proof of income and residency. If you are self-employed, you must submit your income tax NOA.

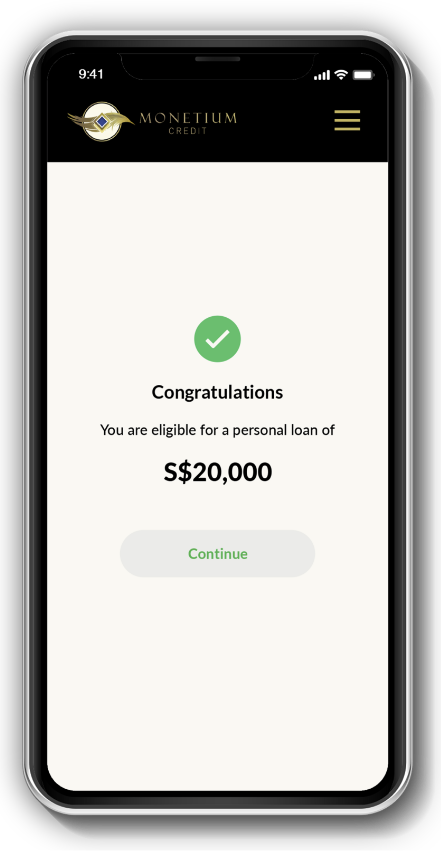

Sign Documents

Our experts will check the documents and provide a positive or negative report on your application in less than 24 hours. The duration depends on your credit. A home renovation loan will receive a response in less than a day, but we may require additional documentation for a mortgage.

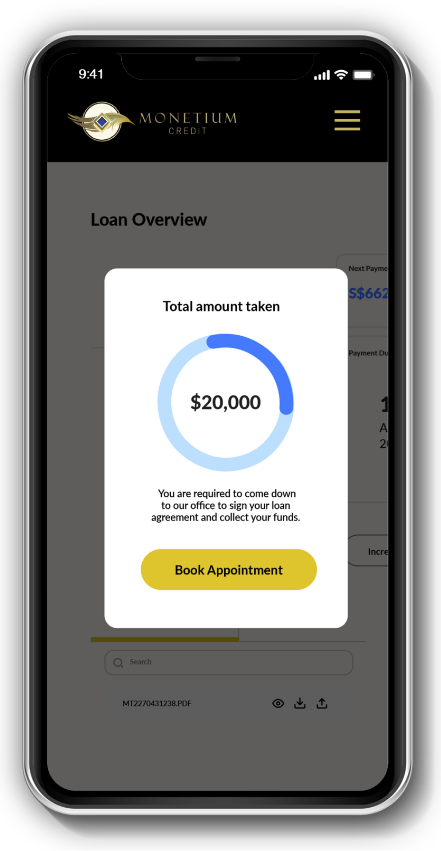

Get the Money

Once the renovation loan is approved, the money will be transferred to your account within two business days. The transaction may take some time, depending on the bank you work with. However, as a general rule, the process should be over in less than a week.

Renovation Loans for Specific Maintenance Projects

Roof

Does your roof need fixing? Have you noticed that your ceiling leaks during heavy rain? If so, you should search for the best renovation loan in Singapore. A personalized home renovation loan Singapore is the perfect solution to fix your roof and improve your dwelling’s thermal efficiency.

Floor

Is your floor dilapidated? Do you want to buy a natural wood floor or upgrade your wooden decking with new tiles? If so, you should go for our home renovation loans. We can offer you the best home renovation loan in Singapore

at an advantageous interest rate.

Walls

Do your walls need a new coat of paint? If so, you should search for the best renovation loan in Singapore. Our loans are affordable, an excellent choice for tight budgets, and more advantageous than those offered by traditional financial institutions. Do you want excellent loan conditions? Then, we are the people to call.

Expansion

Do you want to expand your living space? To remodel your living room, improve the open floor of your apartment, or build a new extension to your kitchen? In that case, you will be interested in the best renovation loan in Singapore offered by our agency. We are renowned for our house renovation loans and can provide varied financial packages.

Plumbing

Did your kitchen plumbing break down? Have your rooms flooded? Do you want to upgrade to newer, more corrosion-resistant pipes? In that case, you’ll be interested in the best renovation loans. We can offer you a house renovation loan that solves your issues and provides you with the budget for your extensive projects.

Electrical

Fixing damaged electrical system can be costly. Do you need a helping hand? Then, look for the best renovation loan in Singapore. Our experts will offer you a house renovation loan that meets your family’s needs and an interest rate that suits your financial possibilities.

Remodeling

We all occasionally want to change the atmosphere of our home. But unfortunately, remodeling your dwelling will be expensive. If you need financial help, looking for the best renovation loan in Singapore is an excellent idea. Our experts will present you with an advantageous house renovation loan that will suit your situation.

Exterior Work

Are you looking for a way to enhance your home’s exterior ambiance? Then you’ve contacted the right people because we can provide a home renovation loan. We are a model for other private financial institutions active in Singapore. We care about our customers’ needs and can provide you with the budget required for your plans.

Contact Monetium Credit

We are the best lender in Singapore for your requirements.

Do you desire specific loans? Then, we have suitable financial packages personalized for your demands.

We are located just 2 minutes walking distance from Jalan Besar MRT

10 Jalan Besar Sim Lim Tower #01-01, 208787

Contact: 6777 7775

To serve you better, we are open for business as follows:

Monday-Sunday - 10:00 am to 7:30 pm

Public Holidays - Closed

FAQs

What is the maximum amount for a home renovation loan?

Under the Moneylender Act of 2009, the maximum amount you can receive for a home renovation loan depends on your annual income. Do you earn less than $10,000 annually? In this case, the maximum amount will be $3,000. Is your annual salary over $20,000? Then, the private financial institutions in our country have no limitation on how much they can offer you.

Am I eligible for a renovation loan with poor credit scores?

Yes. However, credit conditions rely on several factors analyzed while reviewing your documents. Private financial institutions are generally reluctant to offer a home renovation loan to individuals with poor credit. Nevertheless, we are flexible and can work with you to find a solution that will benefit all involved parties.

Can I get two home renovation loans from Monetium Credit?

The answer to this question depends on your finances, the guarantees you present, and the information reviewed during the inspection of your documents. Generally, a second home renovation loan from the same moneylender is unusual. But that doesn’t mean it’s not possible. If you are looking for the best renovation loan in Singapore, we are the right people, and if you have questions, we can easily be contacted.

Will my application be accepted if I have loans from other licensed moneylenders?

Obtaining a home renovation loan while possessing debt from other creditors is possible if your debt-to-income ratio is positive and you can afford the repayment period and the APR. The exact terms of the renovation loan will depend on the information found while analyzing your data. However, as a general rule, having another renovation loan from a different lender will not impact your chances of obtaining credit with us as long as your finances can sustain it.

What is the difference between renovation and personal loans?

A renovation loan is a financial tool used extensively for home improvements. In contrast, a personal loan is a versatile financial instrument that can be used for various expenses, such as medical bills or tuition payments. Personal loans involve a higher APR as they are typically unsecured. However, renovation loans usually include a higher loan amount, which will be linked to the complexity of the renovation work.

Can I apply for the best renovation loan in Singapore without ownership?

It depends on the agreement’s conditions. For traditional, secured renovation loans, lenders usually require ownership or co-ownership of the property. However, owning the property is not necessarily needed for an unsecured renovation loan. An unsecured renovation loan typically has a higher APR and stricter repayment periods. Nevertheless, it is an option to consider if you don’t own the residence you want to renovate.

What is the loan repayment duration?

The repayment duration signifies the timeframe for settling the borrowed amount. If you repay your credit faster, the overall outstanding amount will be lower.

What can I do if the house renovation exceeds my loan?

If the renovation loan does not cover the total cost of the works, you could contact our experts for a top-up of your existing renovation loan or apply for another financial instrument, such as a personal loan. The conditions under which you can obtain two loans simultaneously from our financial institution will depend on your credit score and your annual income. However, in general, as long as your finances permit it, there is no reason why we can’t supplement your existing credit or offer you a new financial product.

How much does a home renovation loan should be?

The cost of renovating your home will depend on the work’s complexity and the type of the dwelling. An apartment requires lower costs, while a multi-story house requires extra funding. You don’t have this kind of cash? If so, a renovation loan will represent your most viable financial tool.

Is it worth getting a house renovation loan?

If you want to improve the ambiance of your property and increase its market value, a renovation loan is an excellent idea. Our country’s housing market is growing steadily, so demand for newly renovated properties is higher than ever. A renovation loan is a favorable financial instrument that can significantly contribute to your family’s economic security.

Quick Links

Login to your bank’s PayNow App & Scan the QR Code to make Payment

Monetium Credit (S) Pte Ltd (201326118D)

DBS Current Account