6777 7775

Sim Lim Tower, 10 Jalan Besar Sim Lim Tower #01-01, 208787

Apply for Debt Consolidation Loan in Singapore

Monetium Credit is one of the best legal moneylenders in Singapore. Our debt consolidation plans are extensive, affordable, and professional.

Monetium Credit is the Best Licensed Moneylender in Singapore

Personalized Debt Consolidation Plan DCP

Our experts will provide a DCP strategy that is tailored to your needs. Our loan process is convenient, and our interest rates are top-notch. You should have no problem contacting our team members and getting the best deal.

Convenient Repayment Schedule

We offer a convenient repayment schedule that benefits you. From management to consultation, we distinguish ourselves from other licensed moneylenders and provide advantageous loan options to secure your financial needs.

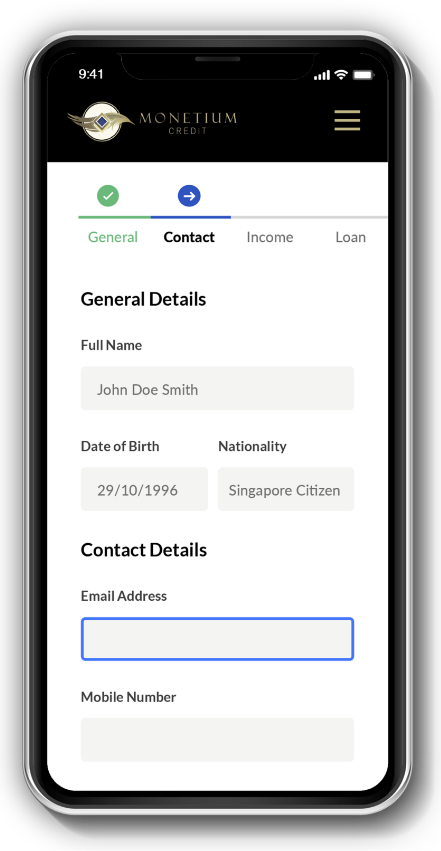

Smooth Application Process

Our application is straightforward, and all the information you need is at your fingertips. Our consolidated loans are recognized for their quality, and we can provide DCP consultation free of charge. We can also cost-effectively manage your existing debt.

100% Data Security & Privacy

We take data security seriously. We are one of the most professional money lenders active in SG; we implement robust encryption methods for our data, we offer an effective interest rate, and we will help you with your debt consolidation plans.

Better Interest Rate

Our financial instruments are perfect for your requirements. We offer a lower interest rate combined with cost-effective DCP plans. With us, you can streamline your debt, consolidate your credit score, and borrow a substantial loan amount suitable for your needs.

Licensed Lender in Singapore

We are licensed and offer everything from business loans to DCP consultation. We can consolidate your credit score, offer an advantageous interest rate, and give you a substantial loan amount. You’ll obtain a lower interest rate and streamline your debt in a single package.

What Is Debt Consolidation Loan Singapore?

A debt consolidation plan is a type of credit in which you combine several debts into a single payment with a fixed interest rate, which will be repaid over an extended term. What are the advantages of such a financial instrument?

More manageable finances

Combining multiple financial duties into a single consolidated plan simplifies your financial management process.

Better interest rates

When you choose a debt consolidation plan, you extend the repayment date of your credit, allowing you to get a more advantageous interest rate.

Avoiding bankruptcy

Do you struggle to meet your financial obligations? If so, a debt consolidation framework can be a lifeline in case of economic struggles.

Apply For A Debt Consolidation Plan Refinance

Are you in debt? Do you want to obtain favorable interest rates? If so, contact our experts for a personalized consultation.

MyInfo

Manual Application

Consolidation Loan to Manage All Your Debts

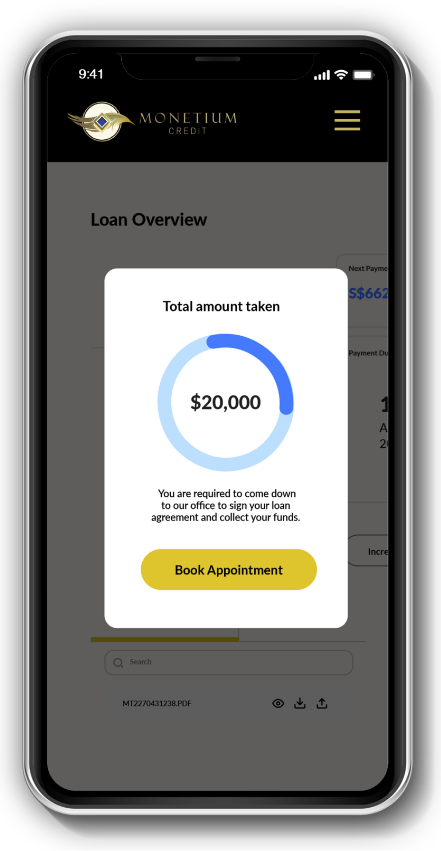

Take charge of your finances and consolidate all your debts into a single loan with Monetium Credit’s Debt Consolidation Plan. Enjoy lower interest rates than other debt consolidation loans for an affordable monthly fixed repayment.

If you are drowning in credit card debt and finding it difficult and painful to track how much you owe in interest payments, our credit company in Singapore can help. We can assist you in consolidating all your outstanding balances from multiple financial institutions to avoid high interest rates and numerous payments every month.

Our expertise provides you with professional advice and helpful, easy-to-understand resources so that you can find the most suitable plan for you. To request a debt consolidation loan in Singapore, please submit your details here. Rest assured that your online application will be processed as soon as possible.

Who is eligible?

For Fixed Salary Employees

- Singapore Citizen, Permanent Resident: Above Age: 21

- Employment Status: Full-time or Part-time

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Computerised payslip / CPF / Bank statement

- Residency proof: Household bills

- Employment contract (For new employment less than 6 months)

Disclaimer: We reserves the right to request for other documentary materials and proofs on a case-by-case basis.

What Documents Should I Prepare for a Loan Contract?

- Singapore Citizen, Permanent Resident: Above Age: 21

- Employment Status: Full-time or Part-time

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Computerised payslip / CPF / Bank statement / Income Tax

- Residency proof: Household bills

- Employment contract (For new employment less than 6 months)

Disclaimer: We reserves the right to request for other documentary materials and proofs on a case-by-case basis.

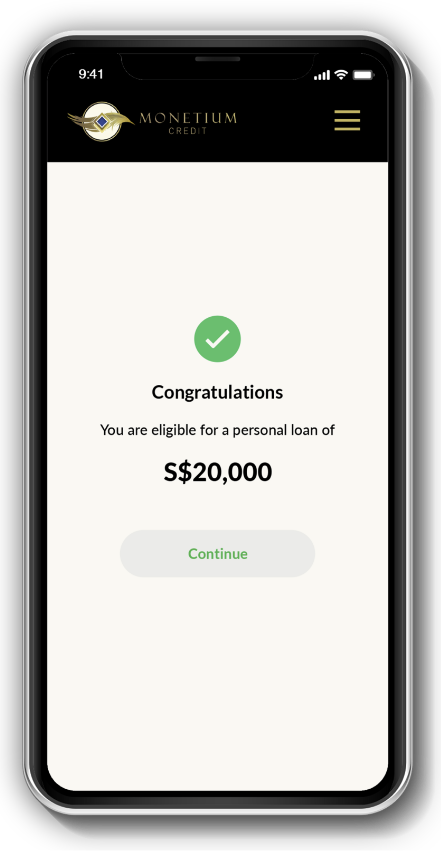

What Happens After the Loan Approval Process is Completed Successfully?

You are eligible if you are a business owner who may or may not be part of the following:

- A sole proprietorship, or Limited Liability Partnership (LLP)

- A private limited company

- A corporation

Documents required:

- Identity proof: NRIC / Passport

- Income proof: Company payslip / Income Tax / CPF

- ACRA Document

- Minimum 2 months of company bank statements

- Corporate and income Tax assessment

Loan Options From Monetium Credit

Personal Loan

A type of financial package suitable for personal purchases or investments in the requirements of loved ones. At Monetium Credit, we can offer a personal loan with a fantastic interest rate and a flexible repayment schedule.

Payday Loan

Life in Singapore is expensive, and you may need an influx of capital. A higher interest rate, which will not exceed 4% per month, can accompany this financial instrument. Moreover, the loan amount will be lower than other options.

Lifestyle Loan

Do you need a vacation? Have you got your eye on jewellery or a new phone? A lifestyle loan can be a perfect financial instrument for subjective requirements, as these credits are used for miscellaneous purchases.

Renovation Loan

These financial instruments are used for housing renovation projects. Do you need a significant loan to cover your bedroom remodelling work? Are you looking for an advantageous interest rate and a flexible repayment schedule? Then, such a credit is an excellent choice.

Business Loan

With an advantageous interest rate and straightforward lending requirements, our business loan proposals are ideal for entrepreneurs looking to start a new chapter in their lives or consolidate the security of their projects.

Mortgage Loan

Extended repayment terms and significant loan amounts characterize this financial instrument. Are you looking for a long-term loan with an excellent interest rate to help you realize your dream of being a homeowner? Then, a mortgage is a must.

Get A Debt Consolidation Plan in 3 Steps

The process of receiving a debt consolidation loan from our moneylending agency is pretty straightforward. There are no hassles and bustles, and you will be able to get the money you need in 24 hours maximum. You can contact our team if you have further questions regarding the process and we will be more than happy to provide with all the details needed. Otherwise, follow these 3 steps and you will get the money in no time!

Fill in the form

You will fill out the application form on the website and provide the necessary information about your financial data.

Sign Documents

You will upload proof of income and residency and sign the necessary documents detailing the credit terms.

Get the Money

Upon approval, you will visit the agency’s office, where you can sign all needed documents and pick up the amount borrowed in cash.

We are always ready to listen to your queries and offer personalized business, DCP, personal, or payday credit consultancy.

FAQs about DCPs

What Debts Can Be Merged Through DCP?

DCPs are designed to merge unsecured financial obligations into a singular financial package with a better interest rate that will be advantageous for your long-term economic stability. What types of debts are included? Everything from outstanding credit card balances to overdrafts and personal unsecured credits obtained from accredited financial institutions. DCP, however, typically does not include more outstanding debt, like mortgages or car payments.

How Can a Debt Consolidation Plan Help Me?

A DCP can be one of your best financial investments. Do you want to merge your debts into a singular financial package with a more manageable interest rate? Do you want to make your payments more straightforward to handle? If so, a debt consolidation strategy is a perfect choice. This type of financial instrument is ideal if you are struggling to pay off your existing financial obligations or if you are keen on streamlining your financial efforts.

Why Should I Choose Monetium Credit?

We are among the most reputable money lenders in SG, and we have a long experience in effective collaborations with clients in different fields of activity. We can offer you an interest rate that contributes to your financial freedom, we are always open to answering our clients’ various questions, we comply with the regulations imposed by The Moneylender Act, and we will provide you with a wide range of financial instruments, suitable for any requirement you may have.

Is Your Company a Legal Singapore Licensed Money Lender?

Yes, our company is one of the one hundred and fifty legal moneylenders that have obtained a license for private financial lending in SG. We abide by the regulations imposed by The Registry of Moneylenders and ensure that your rights are respected. We are open to any questions you may have about our business. We pride ourselves on the numerous awards we have won over the years, and we can offer you the best interest rate in our country.

What Are Your Best Interest Rates?

Our interest rate depends on the credit type and the duration of repayment. However, as licensed moneylenders, we follow the regulations imposed by the Moneylender Act of 2009, limiting the maximum monthly rate of private financial packages to 4%. We are flexible with the rates of our credits, and we can find together a financially responsible plan that will meet your family’s requirements.

Quick Links

Login to your bank’s PayNow App & Scan the QR Code to make Payment

Monetium Credit (S) Pte Ltd (201326118D)

DBS Current Account

Copyright @ 2024 Monetium Credit (s) Pte Ltd. All Rights Reserved. License No 147/2023.

Disclaimer | Privacy Policy | Responsible Borrowing

Monetium Credit (s) Pte Ltd (UEN No. 201326118D) is a registered company under the laws of Singapore. Customers are strongly advised to take a look at our privacy policy & disclaimer sections. If you have any queries or concerns in regards to personal data, please kindly contact [email protected]